ST and HuaHong Semiconductor cooperate to produce 40nm MCU

11/25/2024 7:40:17 PM

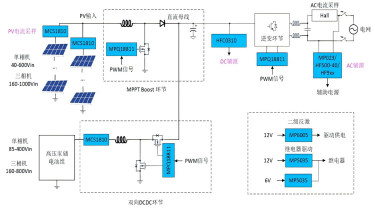

1. STMicroelectronics' 40nm MCU will be outsourced to Hua Hong Semiconductor According to IT Home, STMicroelectronics said at an investor event held in Paris, France on Wednesday that it is working with Hua Hong Semiconductor to produce 40nm process MCU chips in its Shenzhen factory by the end of 2025. Jean-Marc Chery, CEO of STMicroelectronics, said that China is the largest and most innovative electric vehicle market for electric vehicles, which is indispensable to ST, and the company cannot fully compete from the outside. Fabio Gualandris, manufacturing director of STMicroelectronics, said that the reasons for choosing direct production in China include cost-effectiveness and compatibility issues of the Chinese supply chain. This move can also accelerate ST's response to the needs of the Chinese electric vehicle industry and ensure that it keeps up with the development pace of Chinese companies.

2. SK Hynix begins mass production of the world's highest 321-layer NAND flash memory SK Hynix announced that it has begun mass production of the world's highest 321-layer 1Tb TLC 4D NAND flash memory. SK Hynix said that the company will mass produce the highest previous generation 238-layer NAND flash memory products in June 2023 and supply them to the market. This time, it has taken the lead in launching NAND flash memory with more than 300 layers, breaking the technical boundaries. It plans to provide 321-layer products to customers from the first half of next year to meet market demand. SK Hynix adopted the high-production efficiency "3-Plug2" process technology in the development of this product to overcome the stacking limitations. The company's technical team also applied the development platform of the previous generation 238-layer NAND flash memory to the 321-layer, minimizing process changes and increasing production efficiency by 59% compared with the previous generation.

3. Huaxin Microelectronics' first 6-inch gallium arsenide wafer successfully rolled off the production line According to Fast Technology citing news from Zhuhai High-tech Zone, Zhuhai Huaxin Microelectronics Co., Ltd.'s first 6-inch gallium arsenide wafer production line was officially opened recently, and the first 6-inch 2um gallium arsenide HBT wafer was successfully produced, which will be mass-produced in the first half of 2025. According to reports, the wafer has high gain and high efficiency, and can be used in advanced 5G Phase 7/8 mobile phone power amplifier modules and Wi-Fi 6/7 and other equipment. It is understood that Huaxin Microelectronics was established in Zhuhai High-tech Zone in 2023. Its Gechuang Huaxin GaAs wafer production base project is a key project in Guangdong Province and an industrial pillar project in Zhuhai. Since the construction of the project, it took only 184 days to complete the main project capping, 180 days to complete the equipment installation and secondary distribution engineering, and 90 days to complete the equipment debugging and production line connection.

4. GigaDevice announces the progress of DRAM and automotive MCU product lines According to Cailianshe, GigaDevice said on the interactive platform that the company launched DDR4 8Gb products this year and is currently advancing as planned. The company will continue to promote the introduction of DDR4 8Gb products to customers in TV and other fields, and will also launch LPDDR4, which will then complement the niche DRAM product line and widely serve customers in the fields of network communication, industry, TV, smart home, etc. In terms of new MCU products, the company launched the important automotive product GD32A7 in the third quarter, and the chip's functional richness and performance were significantly upgraded compared to the first generation of products.

5. Nvidia's third-quarter performance doubled, but two reasons led to a sharp drop in stock prices According to Fast Technology, on November 20, Eastern Time, Nvidia released its third-quarter financial report. The cumulative revenue in the first three quarters of fiscal year 2025 was US$91.166 billion, a year-on-year increase of 134.85%. According to GAAP, Nvidia's third-quarter revenue was US$35.082 billion, a year-on-year increase of 94%; net profit was US$19.309 billion, a year-on-year increase of 109%. Despite the doubling of revenue and net profit, Nvidia's after-hours stock price fell by more than 5%. First, although Nvidia's net profit in the third quarter increased by 109%, and the revenue outlook for the fourth quarter exceeded the average expectations of Wall Street analysts, it failed to meet the highest expectations. Secondly, the prospects of Blackwell chips are still the most concerned topic in the market. As Nvidia's stock has risen by more than 190% since the beginning of this year, some investors have chosen to take profits.